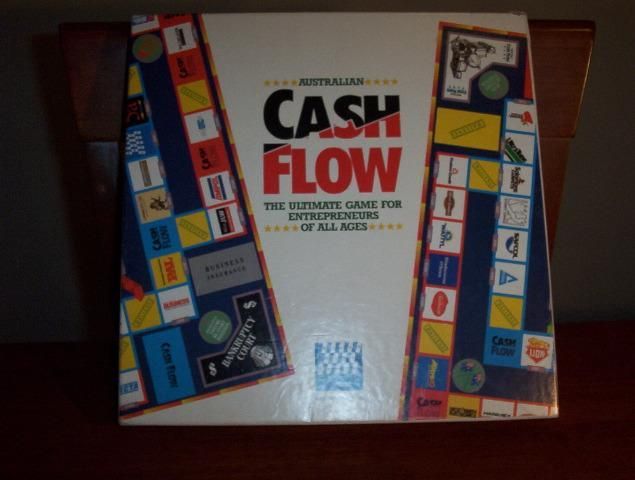

Cash Flow (1987) Board Game

Cash Flow is a board game created by Robert Kiyosaki, the author of the bestselling book series Rich Dad Poor Dad. The game was first released in 1987 and is designed to teach players about financial independence and investing in a fun and interactive way.

Game Components of Cash Flow

How To Setup Cash Flow

To set up the game, each player chooses a token and places it on the “Start” position on the Rat Race path. Each player receives a financial statement outlining their income, expenses, assets, and liabilities. The game includes various investment cards and market data sheets that are shuffled and placed within reach of all players. The money and other financial tokens are distributed according to the game’s rules. The game board is then laid out, and players are ready to begin.

Gameplay Mechanics and Game Objective

Player Experience

Playing Cash Flow is an immersive experience that simulates real-world financial scenarios. Players learn about financial literacy, investing, and managing money through practical and engaging gameplay. The game is designed for 2-6 players and is recommended for those aged 14 and above. It encourages family involvement, making it a great addition to family game nights. The game helps players understand the importance of financial intelligence and how emotional attachments to money can impact decision-making.

Pros

Cons

Personal Thoughts on Cash Flow

Cash Flow is ideal for anyone interested in learning about financial management and investing in a fun and interactive way. It is particularly beneficial for families looking to educate their children about money and financial literacy. The game is also a great tool for individuals who want to improve their financial intelligence and make smarter financial decisions. While it comes with a higher price tag, the educational value and the engaging gameplay make it a worthwhile investment for those serious about financial education.

We are supported by our audience. When you purchase through links on our site, we may earn an affiliate commission, at no extra cost for you. Learn more.